- Published on

Emergency Fund Explained

- Authors

- Name

- Li-Kai Wu

0. Prerequisites

- None

1. Preface

No one knows when an emergency will happen.

That's why it's essential to have an emergency fund in case of unexpected expenses.

An emergency fund can help you cover unexpected costs, such as a car repair or medical bill, without having to go into debt.

If you don't have an emergency fund, now is the time to start building one. You can start small by setting aside just a few dollars each week and gradually increasing the amount as your budget allows.

Having an emergency fund will give you some peace of mind knowing that you're prepared for anything that comes your way!

2. What Is an Emergency Fund?

An emergency fund is a sum of money that you can use to cover unexpected costs, such as a car repair or medical bill.

Emergencies can happen anytime, so it's critical to have a savings account that you can access quickly and easily.

3. What Are the Benefits of Having an Emergency Fund?

There are many benefits to having an emergency fund. Some of the key benefits include:

🧠 Peace of mind ー Knowing that you have a savings account that you can access quickly and easily in case of an emergency can give you some peace of mind.

⚖️ Financial stability ー If you ever experience an unexpected expense, your emergency fund will help you cover the cost without going into debt. Emergencies can happen at any time, so it's vital to be prepared for anything that comes your way. An emergency fund will give you the financial security you need in case of unexpected costs.

4. How Much Should You Save in Your Emergency Fund?

That depends on a few factors, including how much money you make and how many expenses you have each month.

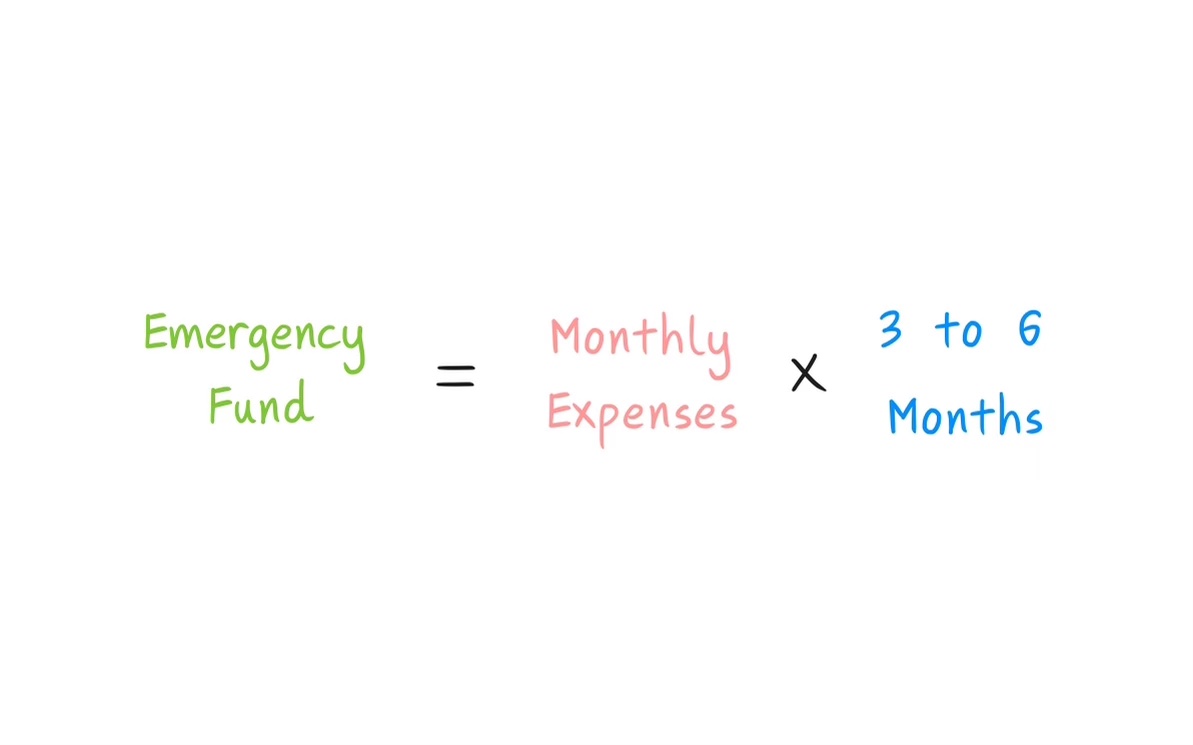

It's generally recommended that you save at least three to six months' worth of living expenses in your emergency fund. That way, you'll be prepared for any unexpected costs that come your way.

It may be tough to save that much money right away if you're just starting out. But don't worry ー you can work towards that goal gradually over time.

Start by saving a little money each week, and then increase the amount as your budget allows.

If you're consistent with your savings plan, you'll be able to reach your goal in no time!

5. Where Should I Keep My Emergency Fund?

There are a few different options for where to keep your emergency fund.

You can keep it in a savings account at your local bank or credit union, or you can invest it in a high-yield savings account or certificate of deposit (CD).

If you're comfortable taking on more risk, you could also invest your emergency fund in stocks or mutual funds.

No matter where you choose to keep your emergency fund, make sure that it's easily accessible so that you can get to it quickly in case of an emergency. And be sure to update your emergency fund regularly, especially if your finances change or you experience any unexpected expenses.

6. How Do I Start Building My Emergency Fund?

Decide How Much Money You Want to Save ー It's crucial to have a goal for your emergency fund. Decide how much money you want to save and work towards that goal.

Decide Where to Keep Your Emergency Fund ー Like I just mentioned above, do you want to keep it in a high-yield savings account? Or do you want to keep it in a CD? Don't forget to browse around to see which banks have the higher interest rates for their savings accounts!

Start Saving Money Right Away ー It can be tough to save money if you don't have any already, but it's essential to start small and gradually increase the amount you save over time.

Automate Your Savings Plan ー Many banks and credit unions will allow you to "link" your savings account with your

checking accountordebit card. If this is an option for you, it's best to automate the transfer so that money goes directly from your paycheck to your savings account without you ever seeing it. That way, you won't be tempted to spend the money!Be Patient and Keep Up the Good Work! ー Your emergency fund will grow over time if you save consistently.

7. Tips for Managing Your Emergency Fund

You can do a few things to ensure your emergency fund stays healthy and grows over time. Here are a few tips:

- Keep Your Savings Account in a Separate Bank From Your Checking Account ー This will help ensure you don't spend the money in your emergency fund by accident.

- Don't Touch the Money Unless You Absolutely Have To ー It can be tough to resist the temptation to spend your emergency fund. Still, it's important to remember that the money is only for emergencies. If you don't have an emergency, don't touch the money!

8. What's an Example of an Emergency Fund?

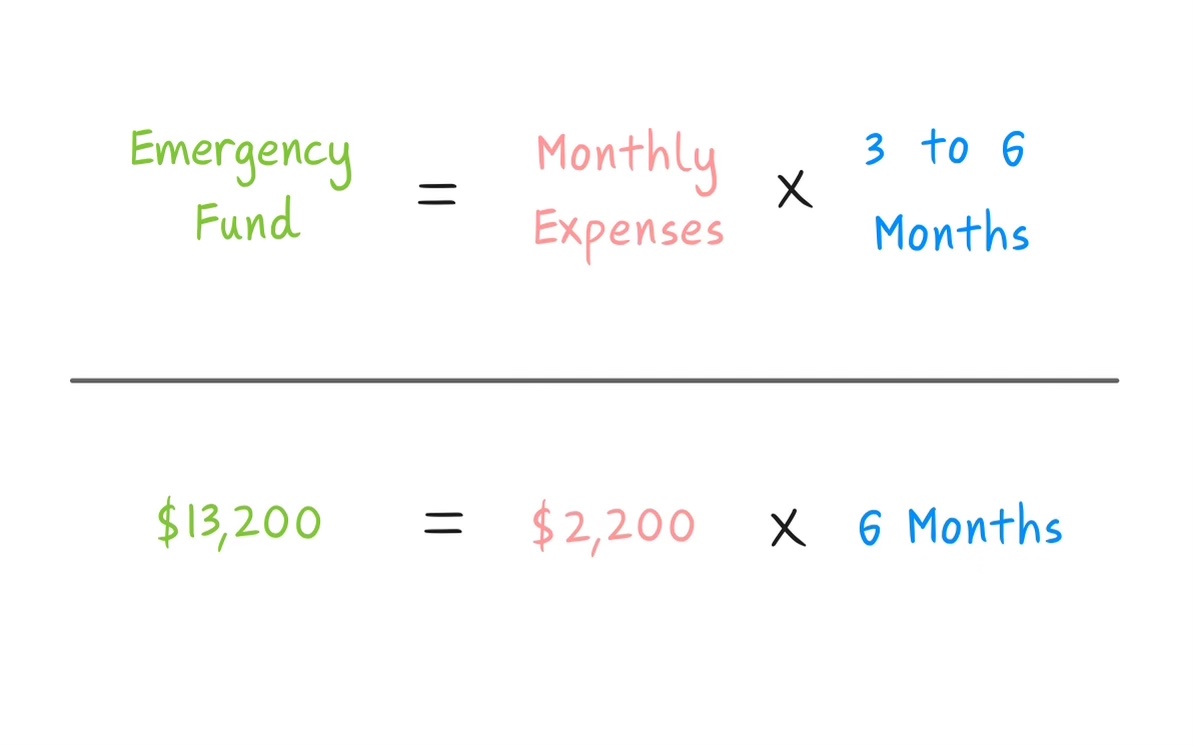

Let's say Tuana has the following expenses in a month:

| Expenses | Amount |

|---|---|

| Housing & Utilities | $1,200 |

| Food | $400 |

| Transportation | $200 |

| Other | $400 |

| Total | $2,200 |

If she wants to save 6 months' worth of living expenses, she'll multiply $2,200 by 6 and get $13,200 for her emergency fund.

If Tuana earns $50,000 (the median income in the U.S.) a year and $39,129 post-tax, she will keep $3,261 a month. Saving 20% of her monthly income will help build her emergency fund in about 20 months.

Of course, the more you save, the faster you will build your emergency fund ー which is highly encouraged!

🥳 Final Thoughts

To recap, an emergency fund is an integral part of personal finance. It can help you cover unexpected expenses in case of an emergency.

There are a few different ways to save for an emergency fund, and it's crucial to start small and gradually increase the amount you save over time.

You should also keep your emergency fund in a separate bank from your checking account to avoid spending the money by accident.

And remember, the money is only for emergencies!